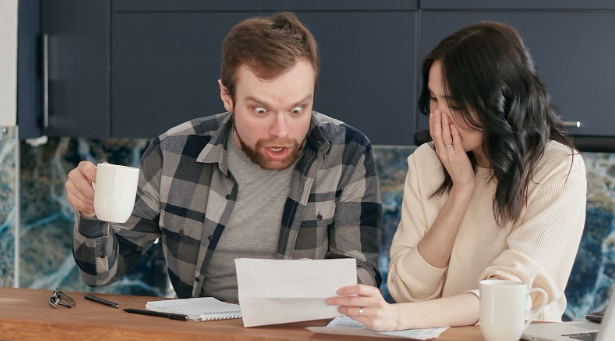

Being upset with my husband for using my bonus on himself – am I the asshole (AITA) in this situation? It’s a question that many may find themselves pondering when faced with a similar dilemma. Recently, I received a bonus at work, which was intended to be used for our joint expenses and savings. However, much to my disappointment, my husband decided to use the entirety of the bonus on himself without consulting me first.

In any relationship, financial decisions should ideally be made jointly, especially when it comes to funds that were meant for shared goals. Discovering that my husband had unilaterally used my hard-earned bonus on his personal desires left me feeling hurt and disrespected. After all, we had discussed our financial plans and agreed upon using the money responsibly.

While some might argue that it’s his right to spend the money as he pleases since it was technically our household income, I can’t help but feel deceived by his actions. It raises questions about trust and communication within our marriage. Shouldn’t we have discussed how best to allocate this extra income?

Ultimately, whether or not I am justified in being upset is subjective and depends on individual values and expectations within a relationship. However, what remains crucial is open dialogue between partners when making significant financial decisions – ensuring transparency and mutual understanding are upheld for a healthy partnership.

AITA for Being Upset with My Husband for Using My Bonus on Him

When it comes to bonuses, they often bring a wave of excitement and anticipation. It’s that extra boost of income that can make all the hard work feel worthwhile. But what happens when your partner makes an unexpected decision with your bonus? That’s the situation our story revolves around.

Imagine receiving a substantial bonus for your exceptional performance at work. You’re envisioning all the ways you could put it to good use – paying off debts, saving for a dream vacation, or investing in your future. However, when you share this exciting news with your spouse, their reaction surprises you.

A Surprise Purchase

In this particular scenario, the husband takes it upon himself to use his wife’s bonus on something entirely different than what she had in mind. Instead of discussing their financial goals together or considering their shared priorities, he decides to make a purchase without her consent.

Perhaps it was a shiny new gadget he had been eyeing for some time or an indulgent treat he felt he deserved. Regardless of the specific item bought, the underlying issue lies in the lack of communication and respect for his spouse’s wishes.

Conflicting Priorities

One could argue that each individual has personal autonomy over their finances within a marriage or partnership. However, when large sums like bonuses are involved, it becomes essential to align one’s spending decisions with mutual goals and aspirations.

The conflict arises when one person perceives their partner’s actions as disregarding their shared financial plans or failing to understand their priorities. It can lead to hurt feelings and resentment if not addressed openly and honestly.

In situations like these, finding common ground is crucial. Open dialogue about expectations surrounding money management and joint decision-making can help couples navigate potential conflicts arising from differing priorities.

By examining the unexpected bonus itself, exploring the surprise purchase made by one spouse without consulting the other, and acknowledging conflicting priorities within relationships, we gain insights into the dynamics at play in this particular situation. Understanding these factors sets the stage for further exploration of whether or not the upset spouse’s reaction is justified.

The Significance of Financial Independence

When it comes to financial independence, receiving a bonus can play a crucial role in one’s personal and professional life. A bonus is typically an additional sum of money awarded to individuals based on their performance or as a reward for their dedication and hard work. It often serves as recognition for achievements and can provide a sense of accomplishment.

Financial independence allows individuals to have greater control over their lives, enabling them to make decisions without relying solely on others or feeling financially constrained. Bonuses contribute to this independence by providing an extra boost in income that can be used for various purposes such as paying off debts, investing in personal growth, or simply enjoying some well-deserved treats.

Remember, every relationship is unique, so finding what works best for you may require trial-and-error along the way. By prioritizing open communication, mutual respect, and shared financial goals, you can navigate money matters in your relationship with greater ease and harmony.